A solid fourth quarter capped off a great year for global markets. The market strength in 2019 was a surprise to many investors who feared an economic slowdown following the bear market in global equities during the fourth quarter of 2018. At that time, the Federal Reserve completed their ninth interest rate increase since December of 2015, and consumer confidence was weakening. Trade tensions were building between the US and China with no common ground in sight.

However, after the first six months of 2019, global equities as measured by the MSCI All Country World Index, had logged the best first half since the index began in 1988. Six months later, global equities finished the year up 26.6%. That is the third highest return in any calendar year since the index began.

Although 2019 provided exceptional returns for investors who were able to stay the course, it was not without reasons to be concerned along the way. With escalating trade tensions and slowing global economic growth, the US Treasury yield curve inverted as the 10-year yield fell below the 2-year yield. A yield curve inversion is viewed as a signal that the risk of economic contraction has risen, and a recession may be on the horizon. On August 14th, at the height of the recession fears, the Dow Jones Industrial Average fell by 800 points, which was the largest drop of the year and the fourth largest point drop of all time. The Federal Reserve stepped in to cut the federal funds rate in three consecutive months from August through October, ultimately stopping at 1.75% where it is expected to remain through 2020.

Currently, trade tensions between the US and China appear to be subsiding while geopolitical tensions between the US and Iran are intensifying. Following an attack by Iranian-backed militia members on the US Embassy in Baghdad, a US airstrike killed Iranian military leader Qassem Soleimani, who the US had designated as a terrorist. Retaliatory actions from Iran included a missile strike on Iraqi bases housing US forces.

As 2020 progresses, US/Iranian relations, the Democratic primary process, and the November presidential election will likely fill headlines, and a contentious election is expected. While the House voted to impeach President Trump, a standoff between the House and Senate caused a pause in the impeachment process. The two articles of impeachment, abuse of power and obstruction of Congress, will be tried in the Senate in the coming months.

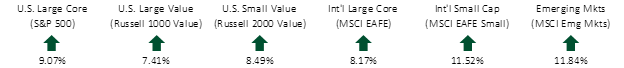

FOURTH QUARTER EQUITY INDEX RETURNS

Global equity markets posted strong returns during the quarter. Emerging markets lead the way and outperformed both US and international developed equities. Growth stocks outperformed value stocks while small caps outperformed large.

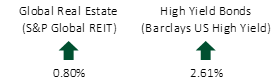

FOURTH QUARTER ALTERNATIVE INDEX RETURNS

Global REITs provided modestly positive returns. This was driven by non-US REITs, which advanced more than 4% during the quarter, while US REITs fell by more than 1%. High yield bonds continued to move higher during the quarter as credit spreads narrowed.

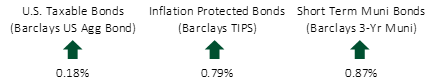

FOURTH QUARTER FIXED INCOME INDEX RETURNS

Interest rate changes were mixed with shorter rates falling and longer rates rising, due in part to the Fed cutting the federal funds rate for the third time in 2019 to 1.75%. The 1-year Treasury yield fell from 1.80% to 1.60% while the 10-year rose from 1.68% to 1.92%, and the 30-year rose from 2.12% to 2.39%.

As we embark on a new decade, it may be wise to reflect on the lessons learned in 2019, which also echo years past. History has shown there is no compelling or dependable way to forecast market returns, yet the professional forecasters will keep trying. Most of the mainstream prognostications will fail to come true and will quickly be forgotten. Investors who are tempted to use recent results as a proxy for future returns are often disappointed, and their actions can have dire consequences for their investment success. Instead, the best strategy is to design an asset allocation that is suited to your unique situation and risk tolerance, and to build a robust set of investments to capture the long-term returns that the markets offer. We do not pretend to know what the next decade will bring, but we are confident that it will be very different from the one that just ended.

If you have any questions or comments regarding the enclosed reports or markets in general, please contact us at any time.