The fourth quarter of 2024 began with Hamas’s reprehensible surprise bombings in Israel on October 7th. The bombardment inflicted a high death toll on Israeli citizens and killed over 1,100 people. Later in the quarter, the intensity of warfare within the Gaza Strip increased, and other militant groups entered the fracas. Throughout the remainder of the year, the conflict spread from Israel outward creating a global response, and the death toll from the war totaled nearly 20,000 by the end of the year. Our thoughts are with all of the families who are affected.

Turning to global markets, financial headlines at the beginning of 2023 were dim. Both equity and bond markets had strongly negative returns in 2022. Inflation in December of that year, though down from the peak a few months earlier, measured 6.5%. Many market experts were calling for a recession in mid-to-late 2023 based on the 2-10 year yield curve inversion and other economic indicators. Despite the negative headlines, the market rally in the fourth quarter pushed the MSCI All Country World Index’s annual return to over 22% for 2023. Additionally, bond markets settled after aggressive rate increases in 2022, and the Bloomberg Barclays US Aggregate Bond Index had a 1-year return of over 5.5%.

The US economy started to stabilize after a tumultuous 2022 as well. The Fed’s aggressive rate hike campaign in 2022 slowed in 2023, and in December, Fed Chairman Jerome Powell announced a rate pause for the third consecutive month. The Fed’s decision to pause rate hikes was driven by the normalization of both prongs of their dual mandate: inflation and unemployment. After inflation peaked at 9% in 2022, CPI measured 3.4% in December of 2023. While this is still higher than the Fed’s desired rate of 2%, it is a sign that the Fed is engineering a soft landing. The unemployment rate has remained close to 3.5% for about a year now after being as high as 14.8% at the beginning of the COVID pandemic in 2020. Forecasters are predicting the rate hike campaign is now over and that multiple rate cuts will potentially take place in 2024.

The US housing market remained challenging through 2023, largely due to high interest rates. In October of 2023, the 30-year fixed mortgage rate hit 7.79%, more than double the 3.09% rate measured 2 years earlier in October of 2021, before the Fed began its rate hikes. In September, home sales fell to their lowest level in 13 years. However, toward the end of the year, the 30-year rate began to decline, ending 2023 at 6.61%. If interest rates continue to fall and the supply of homes available for sale increases, home affordability should improve.

Brent crude prices averaged $19 less per barrel in 2023 than 2022. This came about as global markets adjusted to tensions from the Ukraine-Russia war, and crude oil from Russia began to ship to countries outside the EU. The price at the pump also began to decline toward the end of the year, falling from an average of $3.84 per gallon in August down to $3.13 in December.

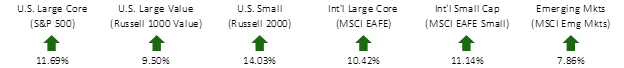

FOURTH QUARTER EQUITY INDEX RETURNS

After a negative third quarter for global markets, equity markets rallied strongly in the fourth quarter. The small cap premium in the US, international developed markets, and emerging markets was positive for the quarter. The value premium was less consistent, showing up only in emerging markets over the quarter.

FOURTH QUARTER ALTERNATIVE INDEX RETURNS

Global REITs were the best performing asset class during the quarter, returning over 15%. This pushed their annual returns to over 10% for the year. Additionally, high yield bonds posted their second consecutive quarter of positive returns, pushing their annual return to over 13%.

FOURTH QUARTER FIXED INCOME INDEX RETURNS

US Treasury interest rates moved differently along different maturity points of the yield curve. However, the net result was strongly positive returns for both corporate and Treasury bonds, as the Barclays US Aggregate Bond Index had a return of over 6.8% for the quarter. Additionally, TIPS and municipal bonds ended the year on a positive note, leading to strong annual returns.

Both the fourth quarter and the full year of 2023 offered good reminders of the importance of staying disciplined while investing. Despite a multitude of negative headlines throughout the year, the late rally for equity and bond markets led to strongly positive overall returns for those who remained invested.

We look forward to connecting with you in 2024, and we wish you the best throughout the new year!