The third quarter of 2023 featured both positive and negative developments. On the positive side, global markets saw gains early in the quarter. Central banks around the globe halted rate hikes as inflation spikes continued to wane, showing the effectiveness of aggressive quantitative tightening efforts. And, the US government narrowly avoided a shutdown by signing into place a temporary spending package. On the negative side, a series of strikes took place across industries, some of which were resolved before the quarter’s end. Toward the end of the quarter, the tides of global equity and fixed income markets turned. Overall, equity and fixed income saw negative returns for the quarter; however, year-to-date equity returns remain strongly positive.

The US government came very close to a shutdown before Congress reached an agreement to sign a stopgap appropriations bill at the 11th hour before the October 1st deadline. The bill funds federal agencies for 45 days at last year’s levels. And while the bill funds food assistance programs, federal wages, and continued access to Medicare and Medicaid, it does not provide for any funding for the war in Ukraine or border policy changes, two major points of contention. The temporary spending package will extend the deadline for a vote on a more permanent spending bill to November 17th.

In part due to the government standoff, Fitch Ratings downgraded US government debt from AAA to AA+ in August. In its decision to downgrade, Fitch cited an expected rise in the US’s debt-to-GDP ratio, an impending increase in interest expense, and numerous political standoffs. A second rating agency, S&P, left the US rating unchanged at AA+, which is a step down from the AAA it applied before 2011. Moody’s, the third primary credit ratings agency, still marks US debt at Aaa, its highest rating.

After China’s post-Covid rebound earlier in the year, it entered an economic malaise during the third quarter. While the rest of the world faces inflationary price pressures, China reached a deflationary state in July when prices fell 0.3% compared to the previous year. Additionally, China’s real estate market continued to show fragility. After the collapse of the conglomerate Evergrande at the end of 2021, China’s largest privately run property developer, Country Garden, missed interest payments on some of its outstanding debt. It was able to pay off said debt within a 30-day grace period, but not before sending ripples of worry throughout markets.

The 30-year fixed rate mortgage continued its upward march, ending the quarter at roughly 7.3%, a level not seen since the end of 2000. These high rates, combined with a housing shortage in the US, encourage would-be sellers to postpone selling because they cannot afford to relocate. This often results in bidding wars on the buy side of the ledger. Consequently, the number of previously owned home sales is down about 36% since January of 2022, while year-over-year home prices reversed a five-month trend of price decreases in July, increasing 1.3%.

In early September, Saudi Arabia and Russia agreed to continue oil production cuts through the end of the year. This announcement came as US crude oil prices increased steadily throughout the quarter. Despite the reduced demand for fuel, higher oil prices have kept fuel prices at the pump steady. At the end of Q3, fuel prices settled around $3.60 per gallon, which is slightly higher than prices at the beginning of the quarter.

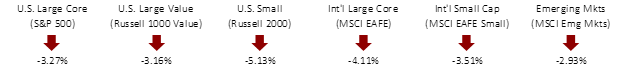

THIRD QUARTER EQUITY INDEX RETURNS

In a reversal from the second quarter, all global equity regions saw negative returns during the third quarter. In the US, small cap stocks were hit hard, losing more than 5%. Despite the pullback, year-to-date performance figures for global equity markets are still positive.

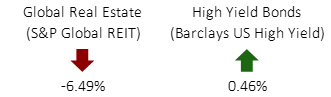

THIRD QUARTER ALTERNATIVE INDEX RETURNS

Global REITs lagged equity indexes, making it one of the worst-performing asset classes year-to-date. Rising interest rates and prolonged heightened vacancy rates in office space have harmed the asset class. High yield bonds had a brighter performance story for the quarter, returning a slightly positive 0.46%.

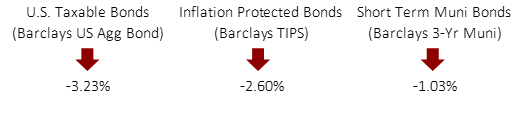

THIRD QUARTER FIXED INCOME INDEX RETURNS

During the third quarter interest rates continued to rise across virtually every maturity in the US, and most foreign government yield curves followed suit. The result was disappointing returns across fixed income asset classes for the quarter.

While equity and bond markets did not offer many sunny headlines for the quarter, returns are still positive for the year. Additionally, the economy provided some better takeaways. First, quantitative tightening seems to have been effective in breaking inflation’s upward trend. This is a good sign in the Fed’s effort to engineer a soft landing for the economy. Additionally, Fed commentary has suggested there will be only one or two more rate hikes through its tightening cycle.

As the fourth quarter began, Israel was the victim of an unprecedented attack by the Hamas militant group. The people of Israel are in our thoughts and we continue to hope for a peaceful solution to the conflict. As always, please reach out with any questions regarding markets or your financial plan specifically.