The second quarter of 2020 offered a reprieve from the unprecedented volatility experienced during the first quarter of the year. Global equity markets were up more than 15% and bonds were positive as well.

As COVID-19 continues to plague the country and the world, there have already been many steps forward, and backward, in the fight. As economies around the world have started to reopen, some have done well and others have struggled. Vaccines are being developed at the fastest pace in recent history and there is hope that a viable vaccine will be available near the end of the year. Given the uncertainty surrounding the virus, the recovery in capital markets has caught some by surprise. Although improving market results in the midst of a recession is not uncommon, it is worth discussing the drivers of such results.

The market volatility in February and March seemed to be a reaction primarily to the health risks posed by COVID-19. The fatality rate in the US and abroad, although not yet crystal clear, is better understood than when the pandemic began, and the CDC’s guidance in mid-March helped sooth some fatality-related fears. However, health fears morphed into economic fears in March as the global economy was shutting down.

Since then, there has been a great deal of stimulus provided by the US and foreign governments that has provided some stability to the markets. The Federal Reserve has essentially promised a backstop to keep the economy moving, and in the past four months they have provided direct stimulus to individuals in the US and instituted a corporate bond-buying program that has allowed many vulnerable corporations to raise cash to maintain solvency.

We view the rally in stocks as markets giving capitalism a chance to adapt, improvise, and ultimately overcome COVID-19. And although many asset classes have had a substantial recovery, several areas of the market are still struggling. Obviously, the travel industry has been upended, financial stocks have lagged, and the energy sector has had its most volatile year on record.

Although still unsettling, unemployment dropped from a high of 14% in April to 11% in June. It looks like that number is continuing to improve, but it was a shock to the system and will take some time to get US employment back to pre-pandemic levels.

Oil prices stabilized during the quarter as well. On January 1, the price of oil as measured by the WTI cash settlement contracts was $61 a barrel. It proceeded to drop to $11 in March as a supply glut flooded the market, and it closed the second quarter at $40 per barrel.

In the midst of COVID-19, the death of George Floyd brought about protests throughout cities in the US and around the globe. Although most of the protests have been peaceful, some devolved into rioting and the institution of curfews. This added more economic stress to many cities that had already been shut down by COVID-19.

Further adding to the uncertainty facing capital markets is the Presidential election in November. The likely Democratic nominee, Joe Biden, has not yet selected a running mate. However, he is leading in the early polls over President Trump.

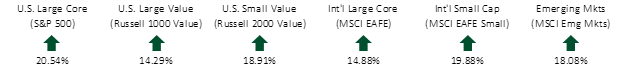

SECOND QUARTER EQUITY INDEX RETURNS

Following the worst quarter in more than a decade, global equity markets staged an impressive rebound. All equity asset classes were up between 15% and 20%. Technology stocks led the charge as remote working and distance learning drove those shares higher.

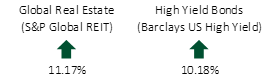

SECOND QUARTER ALTERNATIVE INDEX RETURNS

Global REITs rebounded, but not as significantly as equities. As many companies have employees working from home and retail stores continue to struggle, there is some concern that prices of commercial properties may stall. High yield bonds also staged a recovery as the fear of widespread defaults subsided.

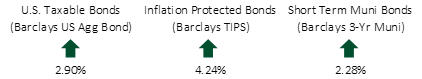

SECOND QUARTER FIXED INCOME INDEX RETURNS

Interest rates stayed stubbornly low during the quarter. The Federal Reserve kept the fed funds rate at 0% – 0.25%. The 1-year Treasury yield essentially stayed unchanged quarter-over-quarter at 0.16% while the 10-year fell from 0.70% to 0.66%. The 30-year yield edged slightly higher from 1.35% to 1.41%. The Federal Reserve indicated that it is unlikely to increase short-term rates before the end of 2021.

Although there is a lot of uncertainty in the world right now, markets have exceled through more challenging times. In the past 100 years, we have persevered through World War I, the Spanish Flu, the Great Depression, World War II, the Korean War, the Vietnam War, the Cuban Missile Crisis, the tech bubble, September 11, and the Great Recession. As much as it might feel different this time, we have confidence that capitalism will overcome this crisis as well.

We hope that you and your family stay safe and healthy during these turbulent times.