The momentum from the fourth quarter of 2023 carried over into the first quarter of 2024. During the quarter, the S&P 500 Index reached 22 new closing highs. The breadth of the index’s returns widened throughout the quarter, as 10 of the 11 industry sectors had positive returns. In similar fashion to last year, a small group of companies drove much of the positive performance. Nvidia, Microsoft, Meta Platforms and Amazon accounted for 47% of the index’s YTD return. While these four of the “Magnificent Seven” companies continued their strong performance, the remaining three (Alphabet, Apple, and Tesla) underperformed the broader index. Tesla was the worst performing constituent of the S&P for the quarter, down 29.3%.

Initial expectations of an imminent interest rate cut by the Federal Reserve dissipated as inflation figures outpaced forecasts and employment continued to be resilient. Jerome Powell’s nuanced commentary hinted at a delayed timeline for anticipated rate cuts, prompting market participants to recalibrate their expectations. Conversely, contrasting dynamics emerged in Europe, where inflation figures fell short of projections, potentially paving the way for divergent monetary policies between the European Central Bank and the Federal Reserve.

Outside Europe, the Bank of Japan raised interest rates for the first time in 17 years from -0.1% to a range of 0 – 0.1% (negative interest rates imply that investors pay the banks to store their wealth). This move in interest rates has more impact than the small change would suggest, as it is a signal that Japan’s era of negative rates may be coming to an end. The BOJ instituted negative rates to deter investors from saving, stimulate investment, and avoid deflation. The recent shift in negative interest rate policy came as major Japanese corporations decided to increase wages for their employees. Additionally, the Nikkei 225 (Japan’s major stock index) hit an all-time high that was previously set 34 years ago.

In the housing market, the National Association of Realtors announced a settlement in an antitrust lawsuit and agreed to pay $418 million in damages. The settlement also came with a few sweeping reforms, most notably regarding commission payments to brokers. Historically, home sellers were responsible for paying both the seller’s brokerage fees and the buyer’s brokerage fees, a standard fare of 6%. The newly proposed fee model, which still needs to be approved by the federal court, would no longer require the seller to pay the buyer’s agent’s fee.

Oil prices exhibited a steady ascent throughout the quarter, with West Texas Intermediate reaching nearly $84 per barrel by quarter-end. This upward trajectory translated into higher gas prices at the pump, with the national average cost per gallon of gas increasing by about $0.30 to $3.54 over the quarter.

In political developments at home, Donald Trump and Joe Biden both dominated the primary elections and secured their nominations for a rematch in the 2024 presidential election.

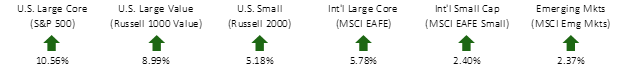

FIRST QUARTER EQUITY INDEX RETURNS

Global equity performance was led by large cap US companies over the quarter. However, international developed equities showed strong performance as well, with the MSCI EAFE returning 5.78%. Value companies and small cap companies lagged their respective counterparts across the globe.

FIRST QUARTER ALTERNATIVE INDEX RETURNS

Despite making a recovery in the final quarter of 2023, global REITs declined in both the US and international markets. However, high yield bonds posted a strong return of approximately 1.5% for the quarter. As bond markets have stabilized, high yield bonds have returned 11.15% over the trailing twelve-month period.

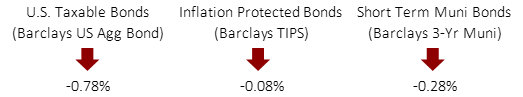

FIRST QUARTER FIXED INCOME INDEX RETURNS

US Treasury interest rates increased at every maturity level during the quarter. Because bond prices move inversely with interest rates, this edged the performance of the US Aggregate Bond Index slightly into the red. The performance of inflation-protected bonds and short-term municipal bonds were down as well for the quarter.

The first quarter of this year offered strong performance across global equity markets with inflation continuing to cool. While it is a reasonable assumption that market volatility could increase as the presidential election approaches, economic growth and a moderation in inflation around the globe should continue to give confidence to investors.

We look forward to connecting with you throughout the year!