From an investment perspective, the final quarter of 2020 ended on a positive note. There was a surge in the number of COVID cases and the political environment was in upheaval, however, the stock market was up double digits for the quarter, partly on hopes that the virus will be contained by vaccines from multiple companies. Bonds also performed well as interest rates stayed near all-time lows.

The first COVID vaccine in the US was administrated in New York on December 14th. Although the rollout of the of the vaccine has not been smooth, it was a welcome step towards ending this pandemic that has thoroughly disrupted the world.

As was predicted by many, the final result of the presidential election was not immediately resolved, and the Senate races did not end until January 5th with a run-off in Georgia. The Democratic Party will have control of the White House, Senate, and House of Representatives.

On January 6th, protestors in Washington, D.C. invaded the Capitol Building for the first time since 1814. Supporters of President Trump were protesting the election results and the impending certification of electoral votes that took place that day.

Unemployment is continuing to recover and the US rate came in at 6.7% in December. The unemployment rate peaked during 2020 at over 14% in April. To provide some perspective, the pre-pandemic level was at 3.5% in February of 2020.

Crude oil prices started to climb along with GDP during the quarter. Crude oil started the year at $61 a barrel, dropped into the mid-teens at the height of the COVID crisis, and closed the quarter at $48.52 per barrel.

The US dollar started to show some weakness during the quarter, giving up approximately 4% of its value to a basket of international currencies including the euro, British pound, and Japanese yen. This was caused in part by the government’s deficit spending during the year in response to the COVID pandemic. The national debt increased by approximately $4.5 trillion to $27.7 trillion, and now equals approximately 130% of US GDP.

The year also saw an increase in the Fed’s balance sheet which expanded from $4.17 trillion to $7.36 trillion. This was a result of the Fed buying treasuries and corporate bonds in order to reduce long-term interest rates to help the economic recovery. Mortgage rates in turn reached record lows during the year, which contributed to an increase in activity and prices in the US housing market.

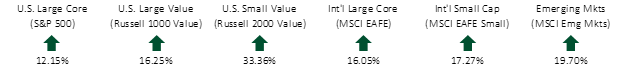

FOURTH QUARTER EQUITY INDEX RETURNS

The fourth quarter produced excellent returns and helped push the global markets into positive territory for 2020. All equity asset classes were up. Value companies performed well relative to growth and small companies had an excellent quarter.

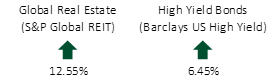

FOURTH QUARTER ALTERNATIVE INDEX RETURNS

Global REITs and high yield bonds also produced solid results. There is still much discussion regarding how the commercial real estate market will fare post-COVID. Will employees get back into the office? Will New York City fully recover? Many of those answers remain to be seen, but markets are telling us that a slow recovery has begun.

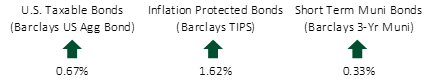

FOURTH QUARTER FIXED INCOME INDEX RETURNS

Interest rates remained low during the quarter as the Federal Reserve kept the fed funds rate at 0%. The 1-year Treasury yield fell slightly from 0.12% to 0.10% while the 10-year rose from 0.69% to 0.93%. The 30-year yield increased from 1.46% to 1.65%. In light of low inflation and a tepid economic recovery, the Federal Reserve reiterated that it is unlikely to increase the fed funds rate until 2022.

As we proceed into 2021, we look forward to getting COVID behind us. Obviously, there will be a lot of news on the political front and the hope is that the climate in Washington settles down. The global economy has fared better than many expected and the capital markets in general held up quite well. Although many questions remain about the pandemic and the strength of the economic recovery, 2020 served as a great reminder about the importance of disciplined investing. At the height of the pandemic, the news was grim, fear was everywhere, and the temptation to exit the equity markets was higher than it had been for over a decade. However, discipline prevailed as equity markets once again demonstrated their ability to quickly incorporate current events and evolving expectations into security prices. Being patient and allowing capitalism to work served investors well.

We hope that you and your loved ones are staying safe and healthy during the ongoing pandemic. Please do not hesitate to contact us if you have any questions.