Despite uncertainty around the midterm elections, additional interest rate increases, and several corporations announcing significant layoffs, the fourth quarter of 2022 featured a much-needed performance comeback across all asset classes. The positive performance numbers of the final three months of the year were not enough to bring most major asset classes’ annual performance numbers back into positive territory, but they helped minimize the declines from earlier in the year and provided good momentum going into 2023.

Certain areas of financial markets featured sharp contrasts when comparing 2022 with the previous two years. First, the FAANG stocks (Facebook [now Meta], Apple, Amazon, Netflix, and Google) propelled growth in equity markets in 2020 and 2021. However, headwinds from rising interest rates and higher borrowing costs in 2022 caused these five firms alone to lose over $3 trillion in market capitalization and to underperform the overall market by a significant margin. Second, the reduced demand for energy in 2020, as COVID restrictions reduced the appetite for travel, caused the energy sector to suffer. In 2020, the MSCI World Energy Index declined about 30%. However, once travel restrictions were relaxed, the pent-up demand pushed the same index to return 40% and 46% respectively for 2021 and 2022. Finally, in 2021 Turkey was the worst-performing country out of all nations across developed and emerging markets. In 2022, Turkey came roaring back as the best-performing country, with the MSCI Turkey IMI Index returning over 100% for the year. While Turkey likely represents a small portion of most investors’ portfolios, all three examples serve as reminders of the importance of diversification.

Turning to the economy, the Federal Reserve is still dealing with a batch of mixed signals as it attempts to engineer a soft landing. While inflation remains high compared to its historical average, the Fed’s actions in raising interest rates helped lower the pace of inflation in the final months of 2022. However, unemployment, another key metric the Fed evaluates while considering rates, is still very low. The Fed is looking for slightly higher unemployment to effectively slow the economy and keep inflation subdued. Finally, in early December, the 10-year minus 2-year interest rate spread reached its sharpest point of inversion since 1981. Historically, this has been a signal of an impending recession, and time will tell whether the indicator proves true once again.

The fourth quarter featured a lot of activity in the oil markets. US crude fell below $80 per barrel from its intra-year high of over $120. Additionally, the G7 nations and Australia established further sanctions against Russia, agreeing not to insure, fund, or ship Russian crude oil if the price is over $60 per barrel. Meanwhile, some of the largest US energy companies reaped the benefits of higher oil prices throughout the year, with Exxon posting an 87% return and Chevron returning 58%.

During the midterm elections, Republicans did take over the House, and early this year Kevin McCarthy won a hotly contested election to be Speaker of the House. Internationally, the war in Ukraine presses on with no clear end in sight.

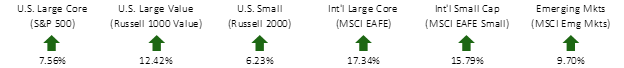

FOURTH QUARTER EQUITY INDEX RETURNS

The fourth quarter saw strong performance for equities across the globe. In the US, value stocks delivered excess performance over growth stocks across all market capitalizations. The value premium also delivered in international developed markets and very slightly in emerging markets.

FOURTH QUARTER ALTERNATIVE INDEX RETURNS

After a steeply negative third quarter, Global REITs made a comeback in Q4, led by international REITs. High yield bonds posted positive returns in Q4 and outperformed traditional fixed income.

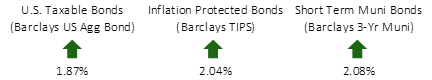

FOURTH QUARTER FIXED INCOME INDEX RETURNS

US bonds had a positive return for the fourth quarter, capping off what will go on record as one of the worst years for bond performance. US TIPS and short-term municipal bonds had positive performance over the fourth quarter, but still posted negative returns for the calendar year. Rising interest rates contributed to much of the decline in bond prices throughout the year, and while this change in rate environment was bad for bonds in the short-term, higher yields will reward bondholders in the future.

2022 was a disappointing year for investors. With both equity and bond markets down, it was a showcase of the risk side of the “risk and return” ledger. While bad years do occur, it is important focus on what you can control as an investor: avoid trying to time when to be in and out of the market, keep a diversified approach, and maintain a belief that capitalism will continue to deliver positive results over time.

For all of us at Heritage, 2023 is a special year, as it marks the 30th anniversary of the founding of our firm. As we look forward to the next 30 years, we want to extend our heartfelt appreciation to all of our clients for making our firm the success that it has become. We are grateful to have all of you as part of our family, and we look forward to working with you in 2023 and beyond.