Following a volatile first half of the year, investors were hoping for a more subdued third quarter. However, from political regime changes in England and Italy, an escalating war in Ukraine, and persistently high inflation, the third quarter showed continued economic and market volatility. Global equity and bond markets started the quarter on a positive note before ending in the red. The downturn in equity markets brought year-to-date performance of US equity indices into bear market territory, and bonds suffered as the interest rate on 10-year Treasury notes rose above 4% for the first time in a decade.

Rising interest rates led to a sharp increase in mortgage rates, cooling the real estate market. The average 30-year fixed mortgage rate experienced high volatility over the quarter, as it started out at roughly 5.7%, dipped below 5% in early August, and eventually ended the quarter at 6.7%. Just one year ago, the 30-year fixed mortgage rate was roughly 3%.

Over the quarter, inflation in the United States hit a four-decade high of 9.1%. As a result, in September the Federal Reserve continued its hawkish measures by raising the Federal Funds rate by 0.75% for the third time in a row. The US was not the only nation battling rising prices, as inflation in the United Kingdom surpassed double digits in July and neared double digits in the eurozone. Despite the high current levels of inflation, the 10-year breakeven inflation rate, which is the market’s estimate of future inflation, is still hovering around 2.45%.

Oil prices declined over the third quarter. Brent crude, the world benchmark for oil prices, dropped from $111 per barrel at the beginning of July to $85 per barrel by the end of September. In the US, the average price of a gallon of gasoline dropped from $5.03 down to $3.82. The Biden administration is continuing to release oil from the Strategic Petroleum Reserve with the goal of reducing upward pressure on oil prices.

Despite all the negative news, there are some positive highlights. Fixed income investments are more attractive now as yields have increased dramatically. Stocks are now cheaper, as price-to-earnings ratios are returning closer to their historical averages. While US inflation hit a 40-year high in June, it decelerated in July and August, which may signify that the Fed’s measures are working.

The economy rests on a solid foundation, with unemployment at 3.5% and housing prices stabilizing. The US dollar saw strong appreciation against other currencies during the third quarter, increasing 6.8% against the Euro and 15.2% against the Yen. The euro is trading below parity with the US dollar for the first time since 2002. While this may create headwinds for US-based multinational companies as US exports become relatively more expensive, it should help foreign companies as their products and services have become less expensive to purchase abroad.

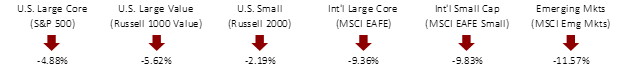

THIRD QUARTER EQUITY INDEX RETURNS

The third quarter saw sharp equity losses across the globe, with US, international developed, and emerging markets all posting negative returns. In the US, small cap stocks outperformed large cap stocks. International and emerging markets equities underperformed relative to US equities.

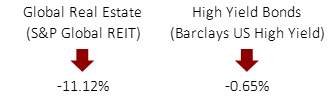

THIRD QUARTER ALTERNATIVE INDEX RETURNS

After a good first quarter, global REITs struggled over the past two quarters. Year-to-date, high yield bonds fared relatively well, as credit spreads widened only modestly.

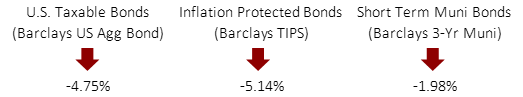

THIRD QUARTER FIXED INCOME INDEX RETURNS

After its worst quarter on record during Q1, the Barclays US Aggregate Bond Index continued its selloff through the third quarter. Short-term municipal bonds held up relatively well, down 5.37% year-to-date. This unusual situation of stocks and bonds falling together has been driven by rising interest rates. Over the third quarter, US Treasury rates rose across all maturity spectrums with short-term rates rising most rapidly. The 1-Year Treasury bill yield increased 1.25% from 2.80% to 4.05%. The 2-Year Treasury bill yield increased 1.30% from 2.92% to 4.22%. The Treasury curve remains inverted as measured by the 2-year note yielding more than the 10-year.

This year continues to be challenging for both equity and fixed income markets. It is easy to get caught up in the “doomsday” predictions from the financial media outlets, however, history has shown time and again that stock and bond markets are resilient and adaptive. The current turmoil is unpleasant, but it is an inevitable part of investment markets, and we remain confident that capitalism will prevail.

Finally, we would like to send our best wishes to those coping with the aftermath of Hurricane Ian. We hope those affected have a speedy return to normalcy. And we hope all of you enjoy the fall season with friends and family. As always, please reach out with any questions regarding your financial plan.