The third quarter of 2020 saw some volatility but ended in positive territory. Growth companies continued their surge higher, along with their expanding valuations. For stocks, July and August were good months but September was down slightly. Bonds also continued to perform well as interest rates hovered near all-time lows. At the time of this writing, mortgage rates hit a new low as the average 30-year fixed rate fell to 2.81%.

News regarding the election competed with COVID for airtime on major news networks. As the country has started reopening, competing philosophies are being debated in the public square and mixed signals are coming from health organizations. It seems that the WHO has come out against lockdowns, which was a reversal from its guidance earlier in the pandemic.

Vaccines are in development for COVID, although some trials were recently halted due to safety concerns. This is not uncommon during clinical trials, but these trials are facing unprecedented media scrutiny. There is uncertainty as to when a vaccine will be available and who will choose to receive it, but the approval process will occur more quickly than the average vaccine.

GDP numbers are coming in better than expected considering the economic shutdown. Quarter two GDP was down 8% while GDP for quarterly three is estimated to be up approximately 8%.

Unemployment is also recovering from the lockdowns at a better-than-expected rate. At the peak in April, unemployment was in excess of 14%, but has since dropped to 8%.

Crude oil prices were effectively unchanged for the quarter. After starting the year at $61 a barrel and dropping into the teens at the height of the COVID crisis, oil closed the quarter at $40 per barrel.

The US dollar also maintained relative strength for the quarter. This surprised some investors as the US has now amassed close to $27 trillion in debt, up from just over $23 trillion in January of this year.

The election is just around the corner and we will be inundated with political advertisement for the next couple of weeks. It is certainly an election with stark differences between candidates, and regardless of the outcome it will likely be a contested result. However, history has shown that capitalism is resilient even in the face of political turmoil, and that the political party in the White House has not been a reliable predictor of future market returns.

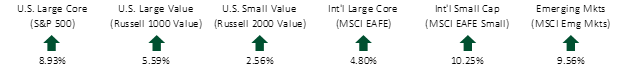

THIRD QUARTER EQUITY INDEX RETURNS

The third quarter produced solid returns following a very good second quarter, which was preceded by one of the worst quarters on record. All equity asset classes were up and growth companies continued to perform well.

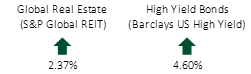

THIRD QUARTER ALTERNATIVE INDEX RETURNS

Global REITs and high yield bonds also produced positive results. Although there are still some questions about the continued strength of commercial real estate in certain markets, the improvement in equity markets and the solid credit quality of many companies seemed to put a floor under publicly traded real estate prices.

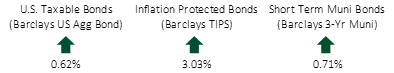

THIRD QUARTER FIXED INCOME INDEX RETURNS

Interest rates stayed stubbornly low and essentially unchanged during the quarter as the Federal Reserve kept the fed funds rate at 0%. The 1-year Treasury yield fell slightly from 0.16% to 0.12% while the 10-year rose from 0.66% to 0.69%. The 30-year yield edged slightly higher from 1.41% to 1.46%. The Federal Reserve indicated that it is unlikely to increase the fed funds rate before the end of 2021.

Over the next several weeks, the election and its aftermath will be front and center. As the country seems more divided than ever, it is easy for investors to think that if the “other” party wins, it will be a disaster. However, history has shown that the political party in office does not reliably predict future market returns.

We hope that you and your family stay safe and healthy during these turbulent times. Please contact us with any questions.