The third quarter of 2019 experienced continued equity volatility, but much like the second quarter, equity markets ended with a final month rally and finished just about flat for the quarter. With intermediate and long-term interest rates hitting near all-time lows, the fixed income markets performed well.

Economic data indicated some signs of a slowing global economy. Part of that was likely related to the continued trade war with China, but a manufacturing slowdown in Europe also contributed. In the US, the Federal Reserve cut interest rates in July and September in an attempt to extend the US’s economic expansion. The European Central Bank responded to weakness by cutting interest rates into negative territory and restarting their quantitative easing.

China’s economy has slowed significantly since the US tariffs were imposed during mid-2018. However, China still reported positive growth and has room to continue negotiations with the US. As of this writing, it seems that “Phase 1” of a deal with China may be in the works and markets have responded positively.

On the political front, Iran bombed the largest oil field in the world, located in Saudi Arabia. The largest oil producer, Saudi Aramco, lost almost half of its production capability due to the bombing. Remarkably, Saudi Aramco indicated that it is back to pumping 9.9 million barrels per day; the same level as before the drone strikes one month ago.

Just after the end of Q3, the US pulled troops out of northern Syria and Turkey invaded immediately. More than 160,000 people have fled northern Syria as the offensive escalates.

In the UK, it seems that the Brexit process will never end. Parliament passed legislation that will force the government to extend Brexit if it cannot reach a deal with the EU by October 31.

In the US, Robert Mueller testified before Congress on July 24th. Nothing came from the testimony that was not expected and the focus against President Trump has shifted from Russia to a phone call that he had with the Prime Minister of Ukraine. An alleged whistle-blower has accused President Trump of abusing his power by attempting to force Ukrainian officials to investigate Democratic presidential candidate Joe Biden relating to work his son, Hunter Biden, had in Ukraine.

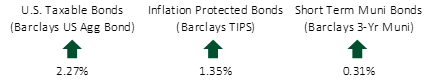

In the US, interest rates fell again across the entire yield curve with the 30-year rate ending at 2.12%. The decline in rates led to a strong quarter for fixed income investments.

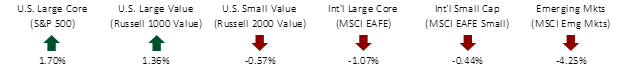

THIRD QUARTER EQUITY INDEX RETURNS

Global equities delivered mixed results for the quarter. It began with strong performance in the technology space and the quarter ended with better performance in value-oriented stocks. Domestic, large capitalization stocks had positive results while small cap US stocks and international stocks were negative for the period.

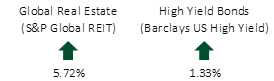

THIRD QUARTER ALTERNATIVE INDEX RETURNS

With declining rates, real estate and high yield bonds performed well for the quarter. Real estate continues to be the best performing asset class for the year.

THIRD QUARTER FIXED INCOME INDEX RETURNS

The Federal Reserve decided to cut interest rates twice during the quarter in an attempt to stem what is anticipated to be a slowing economy. In the past, the Fed generally used rate cuts when a slowdown was imminent or already reflected in reported GDP. This seems to be a new strategy to get ahead of the slowdown and avoid a recession. In the meantime, it has enticed many firms to borrow at what have been historically low interest rates. The 5-year Treasury yield fell from 1.76% to 1.55%, the 10-year from 2.00% to 1.68%, and the 30-year Treasury yield declined from 2.52% to 2.12%.

Over the next year, political headlines are likely to dominate the news. We are often asked how the election might affect the capital markets. The honest answer is that nobody knows the outcome of the election or how the capital markets will be affected if Trump is reelected or if a Democrat takes office. However, the person in the White House does not have as much influence over the markets as the media typically suggests.

If you have any questions or comments regarding the enclosed reports or markets in general, please contact us at any time.