Financial markets were relatively steady during the second quarter of 2023 compared to the previous few quarters. Despite worries about the economy, the ongoing war in Ukraine, and the recent turmoil among the regional banks, financial markets had strong performance across the globe.

Equity markets were led by the United States. The S&P 500 Index has surged by 20% since its lows in October of last year, marking the start of a new bull market. The positive performance can be attributed in part to a renewed emphasis on artificial intelligence and its potential impact on technology firms in the foreseeable future. It was the prominent technology stocks that drove the vast majority of gains within the US market throughout the quarter. Among these stocks, Nvidia, a leading global chip manufacturer and one of the major constituents of the S&P 500, exhibited outstanding growth of over 189% in the first half of the year.

Economic worries persisted as the treasury yield curve’s inversion between the 2 and 10-year maturities reached its steepest levels since 1981. A yield curve inversion has historically been viewed as a signal for a recession. However, despite these concerns, the overall strength of the economy remains intact. The Federal Reserve halted rate hikes in June for the first time since January 2022. This decision coincided with a decrease in inflation to 4% in May, the lowest in two years. Although unemployment ticked up from 3.4% to 3.7% in May, it remains historically low, and the Federal Reserve has hinted at possible future rate hikes as it diligently monitors a range of economic indicators.

Two significant events helped to stabilize the markets during the second quarter. First, Congress reached an agreement to raise the debt ceiling, which eased concerns about a potential global financial catastrophe in the absence of such a decision. Despite emotional reactions from market participants leading up to the resolution, it was not surprising that Congress ultimately found a solution. Resolving the debt ceiling this quarter marked the 79th instance since 1960 that Congress permanently raised, temporarily extended, or revised the definition of the debt limit.

Second, in May, JPMorgan made the strategic decision to acquire First Republic Bank, representing a significant positive development in the regional banking crisis. Through this acquisition, JPMorgan assumed control of approximately $173 billion in loans and $30 billion of First Republic’s securities.

Mortgage rates continue to linger at elevated levels following last year’s steep increases. By the close of June, the average 30-year fixed rate mortgage stood slightly above 6.7%, a decline from the peak of over 7% in late 2022, but much higher than levels seen over the past decade. Despite these high rates, the housing market saw home prices on the rise across the country.

The decline in oil prices has provided welcome relief amidst the high prices observed in other market sectors. In June of 2022, the price of WTI (West Texas Intermediate) crude oil surpassed $120 per barrel. However, by the end of this June, the price had decreased to approximately $70 per barrel. Consequently, the average cost of a gallon of gasoline has decreased to around $3.70 per gallon from over $5.00 a year ago.

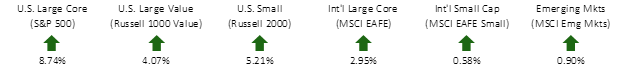

SECOND QUARTER EQUITY INDEX RETURNS

All major regions of global equity markets experienced positive returns. The S&P 500 Index outperformed the EAFE in the second quarter and has outperformed by over 5% year-to-date. Emerging markets lagged the US and international developed markets but have still posted strong positive performance through the first two quarters.

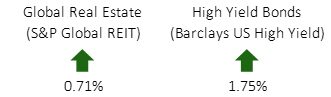

SECOND QUARTER ALTERNATIVE INDEX RETURNS

Global REITs and high yield bonds have both had a much better start to 2023 compared to 2022. The positive second quarter returns of 0.71% and 1.75% pushed the year-to-date returns of global REITs and high yield bonds to 2.09% and 5.38%, respectively.

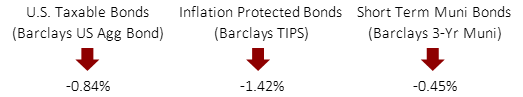

SECOND QUARTER FIXED INCOME INDEX RETURNS

During the second quarter, interest rates around the globe continued to rise, albeit at a much slower pace than last year. The increases in rates led to slightly negative returns in various bond asset classes for the quarter.

Despite negative financial headlines and economists’ opinions about an impending recession, the market has proven resilient through the first two quarters of 2023. Disciplined investors who have stayed the course with a diversified portfolio have been rewarded, and we are once again reminded of the difficulties of timing in and out of markets.

We hope you all have a great summer lined up, full of downtime with friends and family. As always, please reach out with any questions regarding your portfolio or markets in general. We look forward to speaking with you soon!