The second quarter of 2021 continued the trend of strong equity performance. In the fixed income markets, interest rates remained low even though signs of inflation are working their way into the economy.

A new variant of COVID, delta, has become more prevalent in the US and abroad, causing concerns for the welfare of individuals and economies worldwide. Vaccinations are continuing and preliminary research indicates that the current vaccines are working to protect people from the new delta strain.

The excitement around cryptocurrencies abated during the quarter. Bitcoin reached an all-time high near $64,000 in April, but it ended the quarter close to $32,000. Many other cryptocurrencies also declined in value as part of a broader crypto selloff. While the future of cryptocurrencies and the potential capabilities of blockchain technology are exciting, it is still a very speculative market.

As COVID restrictions have begun to ease, a renewed willingness to travel has contributed to an increase in oil and gas prices. West Texas Intermediate Crude, the main benchmark for US oil prices, closed the quarter at $73 per barrel, which is now back to pre-pandemic levels. The spot price of oil was as low as $16 per barrel in April 2020, while the futures price hit an unprecedented negative value at that time. As for gasoline, a ransomware attack in May that led to gas shortages across the Southeast, as well as the Biden administration’s decision to shut down the Keystone pipeline, led to increased prices for consumers at the pump.

In light of the government’s recent spending spree, many pundits have speculated that inflation is on the horizon. In June, the Federal Reserve indicated its intention to shift its timeline on raising the fed funds rate from 2024 to 2023. A rate hike would help keep the economy from overheating and mitigate inflationary pressures. While inflation is nearly impossible to predict, your investments are well-positioned to deal with a wide range of inflationary outcomes.

During April 2020, at the height of pandemic uncertainty, the unemployment rate reached 14.8%. With COVID restrictions easing, many businesses have begun to reopen, and the unemployment rate dropped to 5.9% by the end of this past quarter. As vaccinations continue to roll out and restrictions are further reduced, the employment market should continue to stabilize.

There has also been a lot of discussion regarding the housing market and costs of associated building supplies. The year-over-year median home price from May 2020 to May 2021 increased from $283,500 to $350,300 – a 23% jump. The median number of days that homes were on the market was approximately 17, as reported by the National Association of Realtors. Through the end of the quarter, it was clearly still a seller’s market.

From a currency perspective, the US dollar saw mixed results against international developed and emerging markets currencies. Year-to-date, the US dollar has appreciated against a majority of developed currencies.

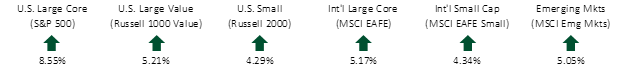

SECOND QUARTER EQUITY INDEX RETURNS

The second quarter saw positive returns across equity asset classes. Within US and international developed markets, value and small companies lagged growth and large cap companies. However, on a year-to-date basis, value and small cap companies are still the best performers.

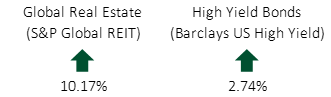

SECOND QUARTER ALTERNATIVE INDEX RETURNS

Global real estate was among the highest performing asset classes over the second quarter, and the real estate market in general is continuing its strong run. High yield bonds in the US lagged the real estate market, but still turned in solid performance.

SECOND QUARTER FIXED INCOME INDEX RETURNS

Portions of the US Treasury yield curve moved in different directions. While 1-year T-bills saw a moderate increase, yields on the intermediate and longer portion of the curve declined, driving prices up considerably.

In terms of performance, inflation-protected bonds realized the best quarterly performance due to their longer duration and fears of higher inflation. US corporate and shorter-term Treasury bonds realized more modest positive returns.

While we are not yet out of the COVID pandemic, as the second quarter came to a close, it started to feel like the world was returning to normal. It is refreshing to see restaurants fully reopening, better attendance at sporting events, and people starting to travel again.

If you have any questions regarding your portfolio, please do not hesitate to contact us. Otherwise, we hope that you enjoy quality time with friends and family throughout the remainder of the summer!