The second quarter of 2019 presented equity investors with some volatility, but ultimately ended on a positive note. April continued the strong performance from the first quarter, however, May was negative for all equity asset classes. June returned to strong performance and allowed the quarter to end with positive returns.

All equity asset classes provided positive results for the quarter, with US companies leading the way. Growth companies continued to outperform value companies and large companies continued to outperform small.

A mid-quarter increase in volatility was in part caused by a breakdown in trade talks with China, which has been an ongoing concern for markets since the first half of 2018. The most recent round of negotiations was suspended in late April, which led to the downturn in May. Although there has not been much good news on the trade front, a lack of bad news allowed the market to climb back to new highs in June. In addition to the stalemate with China, U.S. companies were specifically barred from selling parts to Huawei, China’s largest technology company.

On the political front, democrats have been lobbying for, and have now been granted, the opportunity to have Robert Muller testify before Congress. If Mr. Mueller stands by the comments he made when his report was released in April, he will not provide any information that was not included in the original report. Also, a $4.6 billion humanitarian aid package was approved in order to address the crisis at the U.S.-Mexico border.

In Europe, Theresa May was unable to get a Brexit deal accomplished, which ultimately resulted in her relinquishing her role as the U.K. prime minister. She is currently serving as acting prime minister until the election on July 22nd, which will allow the Conservative Party to pick between Boris Johnson and Jeremey Hunt.

In the U.S., interest rates during the quarter fell dramatically across the entire yield curve with the exception of very short rates, with the Fed Funds target rate staying at 2.5%. The decline in rates led to a strong quarter for all fixed income investments.

During the quarter, tensions escalated with Iran. Over the past twelve months, Iranian oil exports have fallen by 90% due to the imposition of U.S. sanctions. With their backs against the wall, the Iranians lashed out by bombing two oil tankers near the Strait of Hormuz and shooting down a U.S. drone. In response, the U.S. will send 1,000 additional troops and other military resources to the Middle East, and will increase sanctions.

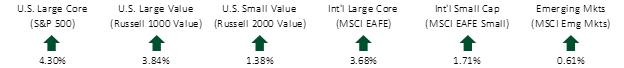

SECOND QUARTER EQUITY INDEX RETURNS

Global equities performed well for the quarter. U.S. companies were led by technology stocks, however, value stocks also performed well. Developed international markets outperformed emerging markets.

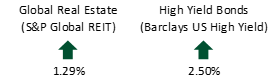

SECOND QUARTER ALTERNATIVE INDEX RETURNS

With declining rates, real estate and high yield bonds performed well for the quarter. Real estate has been among the best performing asset classes for the year.

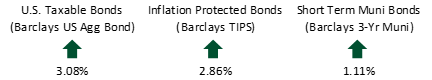

SECOND QUARTER FIXED INCOME INDEX RETURNS

The Federal Reserve’s comments regarding a slowing economy and possible interest rate cuts caused yields to drop dramatically during the quarter. The 5-year Treasury yield fell from 2.23% to 1.76%, the 10-year from 2.41% to 2.00%, and the 30-year Treasury yield declined from 2.81% to 2.52%.

The next several months will be filled with media noise as the democratic primary gets into full swing. With one round of debates under their belts, and several more to come, the field of more than 20 candidates should get honed down to a smaller group for the primary elections, which will start in February of 2020.

If you have any questions or comments regarding the enclosed reports or markets in general, please contact us at any time.