The first quarter of 2023 had a solid start for capital markets. However, following the Federal Reserve’s year-long campaign to raise interest rates, cracks in the financial system began to show. Two bank runs led to the collapse of Silicon Valley Bank and Signature Bank, causing concerns that bank runs might spread to other institutions. The Federal Deposit Insurance Corporation (FDIC) stepped in to insure deposits above the standard $250,000 threshold for Silicon Valley Bank and Signature Bank, which helped alleviate many concerns. Nevertheless, the strains in the financial markets led to a collapse of confidence in Credit Suisse, ultimately resulting in its acquisition by UBS in a deal orchestrated by the Swiss government. Despite the turbulence, both equity and fixed income markets delivered positive returns for the quarter.

These bank runs provide an opportunity to discuss the differences between how assets are held at a bank versus how they are held at a brokerage firm. When investors deposit cash with a bank, those deposits become a part of the bank’s balance sheet (i.e., a liability of the bank), and the bank has the right to lend or invest those funds. Poor management of lending or investments by the bank can put depositors’ funds at risk, as was the case with Silicon Valley Bank. In contrast, non-cash investments held at a brokerage firm do not appear on the brokerage firm’s balance sheet; the assets are held in trust for each client, and creditors do not have a right to those assets, even in the event of the brokerage firm’s bankruptcy. Furthermore, any brokerage firm that is a member of Securities Investor Protection Corporation (SIPC), which almost all are, is covered by SIPC insurance, which protects against fraudulent activities.

In terms of the economy, the Federal Reserve has been on an aggressive interest rate-raising campaign for the past year in an attempt to cool inflation. With their dual mandate of price stability and maximum employment, the Fed is involved in a balancing act with competing forces. As unemployment has remained near historic lows, the Fed has focused almost squarely on reducing inflation. While the rate of inflation has begun to decline, with the CPI-U measuring 6.4% in January and 6% in February, the addition of 517,000 jobs in January led the Fed to continue with rate hikes of 25 basis points in both February and March. In one year, the Fed has embarked on the fastest rate-hiking cycle on record, raising the rate from 0.25% to 4.75%.

In the oil markets, US crude oil prices dropped to a 15-month low in mid-March, falling below $67 per barrel. For comparison, US crude prices exceeded $120 in the first quarter of 2022. Furthermore, the Biden administration announced plans to drill for oil in Alaska, known as the Willow project, which is expected to produce 600 million barrels of oil over a 30-year period.

According to the National Association of Realtors (NAR), real estate prices slowed in February after a period of high activity following the COVID-19 pandemic. Home prices experienced their first year-over-year drop in price since 2012, with the national average declining by 0.2%. This cooling of the real estate market has been primarily driven by rising mortgage rates, with the average 30-year fixed rate mortgage at 6.3% at the end of March. While this rate is lower than the 7%+ rates of late 2022, it is still significantly higher than the rates of a year and a half ago, which were at or below 3%.

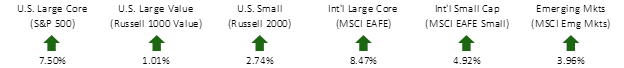

FIRST QUARTER EQUITY INDEX RETURNS

Despite heighted volatility, all major regions of global equity markets delivered positive returns. International developed stocks outperformed US and emerging markets. Across US, international developed, and emerging markets, growth and large cap stocks outperformed value and small cap stocks.

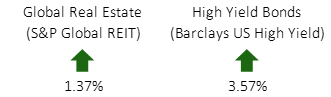

FIRST QUARTER ALTERNATIVE INDEX RETURNS

Global REITs carried positive momentum from the fourth quarter of 2022 into the beginning of this year with a slightly positive return for the quarter. High yield bonds also had a strong return for the first three months of the year.

FIRST QUARTER FIXED INCOME INDEX RETURNS

Last year was one of the worst performing years for US bonds on record. However, US bonds started 2023 on a different note with strong positive returns. Inflation protected bonds and short-term municipal bonds also posted positive results. After the tremendous rate increases from last year, bond yields are now significantly higher than they have been in the years since the global financial crisis.

With the ongoing war in Ukraine, speculation around the Federal Reserve’s actions, and fears from the recent bank runs, many pressures continue to affect the market. Despite these pressures, the first quarter of 2023 managed solid returns across virtually every asset class. This is a reminder that diversification and refraining from market timing have continued to generate successful investment outcomes.

We hope you have had a great start to 2023, and we look forward to hearing from our clients throughout the year. As always, if you have any questions regarding markets, your portfolio specifically, or financial planning in general, please call or email us.