The epidemic that has seized the country is of serious concern from a healthcare, humanitarian, and financial perspective. It is a pandemic the likes of which we have not witnessed in multiple generations, and no pandemic has ever had so much media coverage and minute-by-minute statistics to dissect it.

As the crisis unfolds, the impact of the coronavirus on human behavior, capitalism, and global markets is becoming clearer. Humans do a great job of adapting to their environment and that is something that has served us well throughout history. As recently as the end of February, the thought of shutting down the country for two months was inconceivable. We saw it happen in China but we never thought it would happen in America. Even those who believed that the pandemic would affect the US did not think that it would come to social-distancing and an economic shutdown of the country.

The onset of the virus was a surprise, but the world’s reaction has been dramatic and swift. Vast resources have been deployed to offset the economic costs, slow the spread of the disease, and develop a treatment and a vaccine. It will work, the world will get back to normal, and there will be future benefits to our current plight. The entire world has learned a great deal about viral containment and the reaction to the next viral outbreak will be more efficient and less impactful to the economy. If COVID-19 or a similar outbreak comes again, it will not be as shocking or cause as much volatility if it is addressed with the additional knowledge that we have gained.

As for the capital markets, every aspect of the economy has been affected. Global stock markets were down 25% in the first quarter. Oil prices started the year at $60 per barrel, and between a lack of demand created by the global economic shutdown and a price war between Russia and Saudi Arabia, oil ended the quarter down 66% at $20 per barrel. This affected energy companies significantly.

High-quality fixed income has held up well, and most high-quality bonds were flat for the quarter. Over the past few years, we had the benefit of the Federal Reserve raising interest rates slowly from close to zero up to 2.5%. Over a two-week window after the pandemic started, rates were cut back to zero. Although falling yields are generally good news for bond prices, the flight to quality drove US Treasuries higher and other bonds temporarily lower. The bond markets rebounded within a few days and provided the stability that we count on during difficult times.

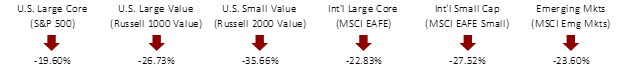

FIRST QUARTER EQUITY INDEX RETURNS

Global equity markets posted the most significant quarterly declines since the financial crisis of 2008-2009. Large US companies were down the least with a loss of approximately 20%, while small cap value stocks were down more than 35%. Financial and energy stocks were hit hardest.

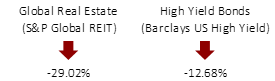

FIRST QUARTER ALTERNATIVE INDEX RETURNS

Global REITs were down significantly as businesses were shut down and payments of rent were brought into question. High yield bonds were also down during the quarter as spreads between government bonds and corporate bonds hit their highest level since 2009.

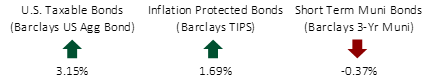

FIRST QUARTER FIXED INCOME INDEX RETURNS

Interest rates collapsed during the quarter. As mentioned above, the Federal Reserve cut interest rates twice during two emergency meetings. The fed funds rate now stands at 0% – 0.25%. The 1-year Treasury yield fell from 1.60% to 0.17% while the 10-year fell from 1.92% to 0.70%. The 30-year dropped from 2.39% to 1.35%. For the first time ever, the 30-year briefly dropped below 1% during the quarter.

As we mentioned in our last quarterly commentary letter, there is no compelling way to forecast market returns. This quarter certainly highlights that fact, along with the risks associated with capital markets. Risk is the unknown. That is why the coronavirus today is less risky than it was two months ago. On a global basis, we understand the implications a bit better, we will test more frequently and efficiently to stop future outbreaks, and we have all learned what social-distancing entails. Although we will have some rough periods going forward, our country and the world will ultimately come out stronger because of it.

This is a difficult time for everyone. In addition to general health concerns, we realize that market volatility can also be a contributor to stress. Please know that we have carefully reviewed your allocations and we feel comfortable that you are properly allocated between equity and fixed income from a financial perspective. However, please also know that we are always available to discuss your allocation with you if you are uncomfortable with your current level of risk.

Please be safe and let us know if you have questions or concerns.