The first quarter of 2019 delivered a welcome market recovery following the fourth quarter of 2018. Soon after the end of the year, the 35-day government shutdown ended, promising news surfaced regarding US-China trade relations, the Fed signaled more accommodative monetary policy, and most of the economic data was strong. All of these factors contributed to a rebound in global stock markets.

All equity assets classes provided positive results with US companies leading the way. Growth companies outperformed value companies and large companies outperformed small.

US GDP in the fourth quarter was revised a third time to 2.2%. Although lower than the previous two quarters, it was still a better result than expected given all of the economic headwinds experienced during the quarter. For the calendar year 2018, GDP was revised to 2.9%, which was the best annual growth rate in over a decade.

Although there is not currently a formal resolution to the trade dispute with China, it is being reported that a deal looks promising. The impact of tariffs on China has put pressure on their economy and the dispute is one of the factors that led to market volatility at the end of 2018. It seems that both the US and China are ready to negotiate.

On the political front, Robert Mueller’s highly anticipated report on President Trump’s alleged collusion with Russia and possible obstruction of justice was released to the Justice Department. Following that release, a four-page summary of the report was delivered by Attorney General Barr. Although much political theater will come from what will be a redacted Mueller report once released to Congress and the public, it is unlikely that any material change will result from the release of the report, and also unlikely that entrenched opinions will change on either side of the aisle.

The Federal Reserve recognized that the slowdown at the end of 2018 would likely impact GDP going forward, and indicated that interest rate increases during 2019 are unlikely.

In Europe, it is clear that Brexit will be the center of attention for the next several months. After three failed attempts by Theresa May’s government to get the British Parliament to pass acceptable terms for a break with the European Union, she was at least able to obtain a vote to extend the final deadline for Brexit to October 31, 2019. However, if Theresa May’s government can somehow obtain an agreement sooner, it could be voted on and passed any time before that deadline.

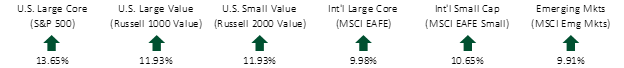

FIRST QUARTER EQUITY INDEX RETURNS

Global equities experienced the best return in over eight years. With global monetary policy loosening and earnings still growing at a steady pace, the markets reacted well.

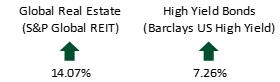

FIRST QUARTER ALTERNATIVE INDEX RETURNS

Real estate securities also increased significantly for the quarter; a result of lower interest rates and decreased market volatility. Both international and domestic real estate performed well. High yield bonds also turned in a good quarter.

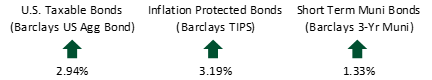

FIRST QUARTER FIXED INCOME INDEX RETURNS

Following concerns about global economic growth, the Federal Reserve and many foreign central banks provided guidance that near-term monetary policy would be more dovish. Yields on mid and long-term bonds dropped sharply and hit the lowest levels since 2017. The 5-year Treasury yield dropped from 2.49% to 2.23%, the 10-year from 2.69% to 2.41%, and the 30-year Treasury yield declined from 3.02% to 2.81% during the quarter.

As we begin the second quarter it is always nice to have a great first quarter behind us. Overall, it seems that the global economy is doing well and growth is stable. However, with a turbulent political environment, Brexit on the horizon, and the mechanics of a US-China trade deal in the works, there will be a lot of headlines and possible volatility throughout the summer.

If you have any questions or comments regarding the enclosed reports or markets in general, please contact us at any time.