I was on holiday during the stock market’s recent ups and downs and missed out on the media coverage and the surrounding “will they/won’t they” China tariff news. That is actually my preferred way of coping with market volatility, which is to be unaware of it in real time. While I don’t always have a built-in buffer, there’s certainly an argument for tuning out daily market movements.

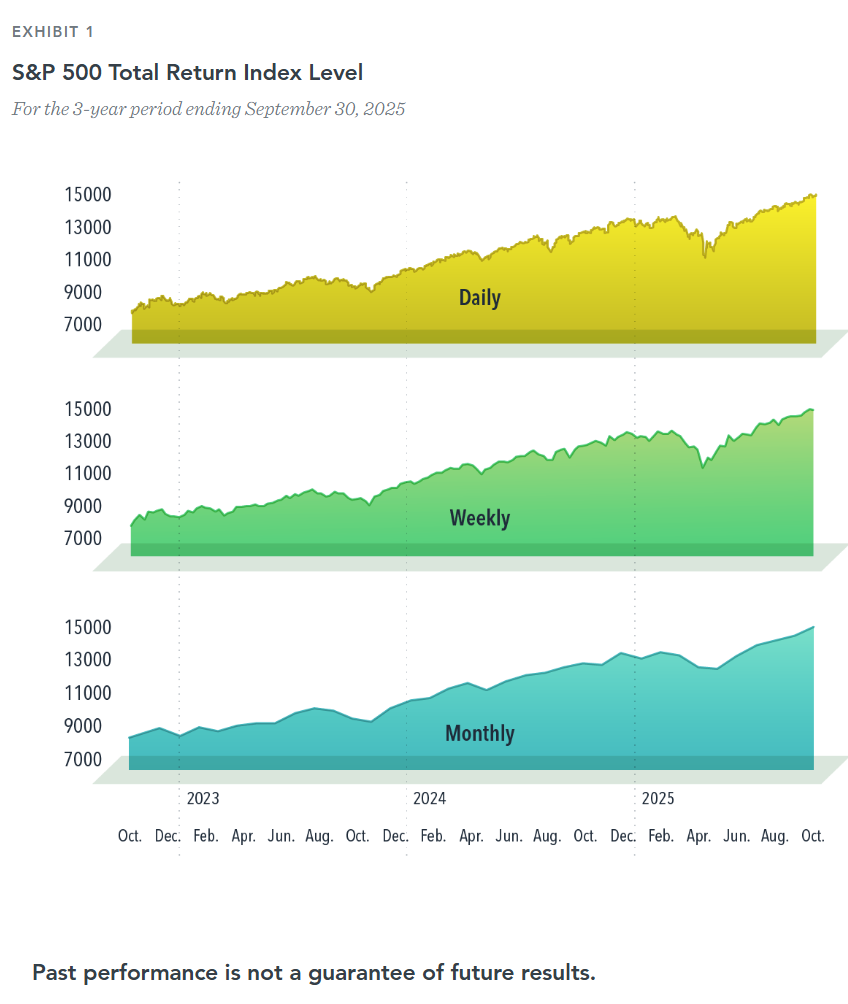

The benefit of the ignorance-is-bliss approach can be visualized by plotting out returns at longer time intervals. As you switch from daily returns to weekly, the jagged edges begin to smooth out. By the time you get to monthly returns, some of the big drawdowns (e.g., third quarter of 2023, April 2025) seem like small blips during an otherwise continuous climb.

A desire to stay informed about what’s going on in the world is human nature, and developments with the stock market are part and parcel of that. But thinking about investments in a long-term framework might dull the temptation to make asset allocation changes that studies have shown are a recipe for disappointment.

In USD. S&P data © 2025 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management

of an actual portfolio.

The original version of this article has been reprinted with permission and was written by Wes Crill, PhD Senior Investment Director and Vice President of Dimensional Funds Advisors.

This content is developed from sources believed to be providing accurate information and provided by Dimensional Fund Advisors. Please consult legal, finance or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information and should not be considered a solicitation for the purchase or sale of any security.