The fourth quarter of 2025 concluded a year defined by resilience amid political and economic turbulence. Headlines included the longest U.S. government shutdown in history, renewed trade negotiations, and two Federal Reserve rate cuts. Despite these challenges, global equity markets closed the year near record highs, underscoring the benefits of disciplined investing and global diversification.

Developed markets outside the U.S. led performance over the quarter, while emerging markets also posted strong returns. U.S. equities delivered positive results, though they trailed their international counterparts. Real estate investment trusts (REITs) were a notable exception, as U.S. REITs dragged the global REIT index into negative territory for the quarter. Fixed income markets gained modestly, supported by falling short-term yields, as investors responded to the Federal Reserve’s rate cuts and easing inflation pressures.

The U.S. economy navigated a complex backdrop in Q4. The government shutdown, which began in October and stretched into November, delayed key economic data releases and weighed on consumer sentiment. Inflation moderated at year-end, with headline CPI easing to 2.7% in November from 3% in September. Labor market signals were mixed; job gains surprised to the upside in September, but unemployment ticked higher in November. The Federal Reserve cut rates twice during the quarter—once in October and again in December—bringing the federal funds target to 3.75%. Policymakers remained divided on the path forward, balancing concerns over inflation against signs of labor market softening. Abroad, the Bank of England implemented a rate cut, while the European Central Bank held rates steady. Inflation in Europe hovered near target, and the U.K. saw further moderation.

Mortgage rates continued their downward trend during the quarter, offering some relief to prospective homebuyers. The average 30-year fixed rate fell to roughly 6.15% at the end of December. While still elevated, the figure represents a decline of roughly 70 basis points compared to December 2024.

Crude oil prices fell sharply in the fourth quarter, with Brent and WTI benchmarks ending the year near multi-year lows, as oversupply concerns outweighed geopolitical risks. This decline filtered through to consumers, with the average U.S. price for regular gasoline dropping to $2.89 per gallon in December—down more than 5% from November and roughly 4% lower than a year earlier. Diesel prices also eased, averaging $3.62 per gallon at year-end. Lower fuel costs provided modest relief for households during the holiday season, capping a year of declining energy prices.

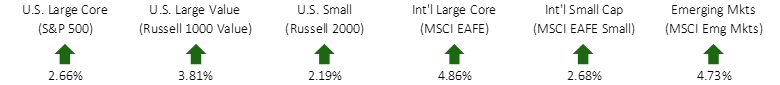

FOURTH QUARTER EQUITY INDEX RETURNS

Global equity markets ended the year with a strong fourth quarter. International developed and emerging markets led the charge, with

US stocks still posting strong returns. For 2025, the MSCI EAFE and MSCI Emerging Markets Indices each had a return of over 31%. The S&P had a total return of just under 18% for the year.

FOURTH QUARTER ALTERNATIVE INDEX RETURNS

Global REITs had a negative return for the quarter as the asset class continues to look for solid footing after the Covid pandemic. For the year, international REITs had strong returns, but US REITs lagged their peers significantly. The strong momentum built earlier in the year for high yield bonds carried through the fourth quarter and pushed the annual return for high yield bonds to over 8.5%.

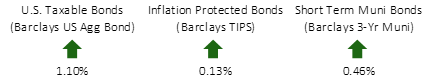

FOURTH QUARTER FIXED INCOME INDEX RETURNS

Fixed income markets had favorable returns over the fourth quarter, helped along by falling short-term interest rates in the US. The US Aggregate Bond Index returned over 7% for the year and municipal bonds also had strong positive returns.

As we reflect on an eventful fourth quarter and an extraordinary year, we are reminded of the value of staying disciplined through periods of uncertainty. Despite political headlines, economic crosscurrents, and market volatility, diversified portfolios were rewarded for their resilience.

We hope you are looking forward to 2026 as much as we are. Please reach out if you have any questions about your portfolio or planning needs—we are always here to help.