The second quarter of 2025 was a tumultuous time for global financial markets, marked by sharp volatility driven by geopolitical events and mercurial trade policy decisions. Investor sentiment was bullish early in the year, pushing the S&P 500 to an all-time high on February 19th. However, optimism began to fade after President Trump’s “Liberation Day” announcements on April 2nd, which included the unveiling of a new tariff policy that unsettled markets. The S&P 500 plummeted nearly 19% from its February peak, bottoming out on April 8th as investors braced for the economic fallout of the new trade measures. In a dramatic turn, Trump announced a pause on the tariffs shortly thereafter, triggering a swift market rebound. The index surged nearly 25% from its lows, ultimately reaching multiple new all-time highs before the quarter ended. While markets have recovered, the broader implications of the tariff policy remain unresolved, with ongoing negotiations and adjustments to trade terms between the U.S. and its partners.

While the tariff-related volatility dominated financial markets, the most significant geopolitical event of the quarter was the eruption of hostilities between Israel and Iran. The conflict began with Israel’s bombing of Iran, a move that escalated tensions over Iran’s stalled nuclear talks with the U.S. and other world powers. Over the course of the next twelve days, the situation intensified, culminating in the U.S. bombing three major Iranian nuclear facilities. In response, Iran launched retaliatory strikes on U.S. military bases located throughout the Middle East. Fortunately, the Iranian strikes were symbolic in nature, and no American casualties were reported. Despite the relative lack of direct impact on the U.S., the war caused significant disruptions in global energy markets and heightened uncertainty regarding the stability of the region. The situation remains fluid, with geopolitical risks continuing to weigh on investor sentiment.

Domestically, the U.S. economy remained in a delicate balance, with the Federal Reserve opting to maintain its target interest rate range of 4.25-4.5% in both May and June. This decision came as the Fed weighed the potential inflationary pressures from tariffs, which had yet to be fully factored into the economic landscape. The central bank’s cautious stance reflected its ongoing concerns about inflation and its commitment to address rising prices without stifling economic growth. With rates unchanged since December of last year, the Federal Open Market Committee (FOMC) has continued to signal that it expects to implement two rate cuts later in 2025, contingent on further economic data. These decisions underscore the Fed’s careful approach to managing the economy amidst both domestic and international uncertainties.

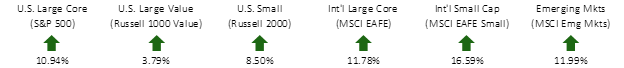

SECOND QUARTER EQUITY INDEX RETURNS

While global equity markets had varied returns across different geographies during the first quarter, positive returns were posted across all markets during the second quarter. US markets rebounded strongly over the quarter, and international developed and emerging markets continued to outperform.

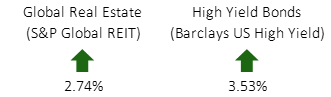

SECOND QUARTER ALTERNATIVE INDEX RETURNS

Global REITs continued to find their footing over the quarter after an extremely volatile last few years. High yield bonds also had a strong quarter, with a return of over 3.5%. This pushes the asset class’s trailing 12-month total return to 10.29%.

SECOND QUARTER FIXED INCOME INDEX RETURNS

Fixed income markets also had positive returns and served their role in the portfolio as a ballast to counterbalance the equity pullback at the beginning of the quarter. The Bloomberg Aggregate Bond Index is now up over six percent for the past 12 months.

The second quarter served as an excellent example of the need to remain disciplined and adhere to your long-term investment plan. A lot of fear came into play when markets were adjusting to the news of Trump’s tariffs, but markets rebounded quickly and rewarded disciplined investors with positive returns by the end of the quarter.

We hope you all have a great summer and early fall. If you have any questions or concerns, please call or email us!