The first quarter of 2021 delivered excellent equity performance. U.S. stocks, particularly value and small cap companies, delivered the best results. Fixed income prices showed weakness as interest rates edged higher and inflation exceeded 2% for the first time in a year.

COVID continues to be in the headlines, but some of that news has been positive. Already, almost one half of all Americans have received at least one dose of the vaccine. It is anticipated that most of the country will be reopened by mid-summer.

As we work our way through the COVID crisis, one of the economic surprises has been the strength in the housing market throughout the country. Although a few large cities are struggling with a weakening housing market, a majority of the country has seen double digit increases in home prices and a limited supply of homes on the market.

At the beginning of February, retail trading in GameStop and several other so-called “meme stocks” became a rallying cry for smaller investors to inflict pain on hedge funds that were betting heavily against these companies. Some hedge funds were hurt, but the volatility cut both ways and many individual investors also experienced large losses when their trades went against them. The extreme volatility has subsided, but heavy trading volume in those companies is still occurring.

On the political front, President Biden took office in January. After much consternation related to the invasion of the Capitol Building and the contested election in Georgia, attention is now focused on the initiatives of the Biden administration. Over the next several months, we will be closely monitoring news related to potential changes in income and estate tax laws.

Unemployment has seen mixed results this year. Many employers with entry-level positions to fill are having a hard time finding employees. This is due in large part to government stimulus payments and unemployment benefits, which can rival the pay from those employers. That, in turn, is creating a disincentive to work and is hurting some employers.

Crude oil prices spiked at the beginning of the quarter, jumping from $48 to $60 per barrel. Overall, oil prices for the quarter were up over 20%, and gasoline prices rose accordingly.

The US dollar advanced during the quarter against most currencies. Up to this point, the strength of the US economy has helped offset potential dollar weakness following the trillions of dollars created to stimulate the economy during the pandemic. Many experts are expecting inflation to increase over the next several quarters.

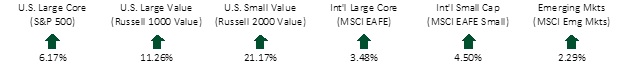

FIRST QUARTER EQUITY INDEX RETURNS

The first quarter produced excellent returns across all equity asset classes. As mentioned above, value and small companies, which had struggled during the pandemic, were the leaders for the quarter. International companies, while producing good results, lagged behind the U.S. markets. Many foreign countries are still facing COVID restrictions and those economies have not recovered as quickly as the U.S.

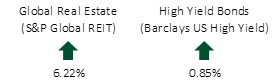

FIRST QUARTER ALTERNATIVE INDEX RETURNS

Global real estate recovered during the quarter after a lackluster 2020. There has been weakness in large U.S. real estate markets on the office and retail fronts, however, other areas such as apartments and storage have done well. Strong corporate earnings and higher interest rates kept high-yield bonds in positive territory for the quarter.

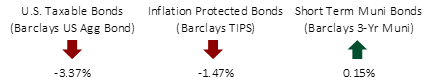

FIRST QUARTER FIXED INCOME INDEX RETURNS

For the first time in many quarters, everything but the shortest portion of the yield curve experienced increasing rates. The 1-year Treasury declined from 0.10% to 0.07% while the 10-year rose from 0.93% to 1.74%. The 30-year yield increased from 1.65% to 2.41%. Reported inflation for the quarter was 2.6%, which was greater than expected. With the increase in rates, the returns of taxable bonds were negative for the period. Short term municipal bonds held up well as demand for tax-free bonds remained strong.

As we continue through 2021, we hope that the negative health effects of COVID continue to improve, and eventually we can return to a sense of normalcy. Capitalism proved resilient during the pandemic, and government stimulus helped foster good performance in capital markets. We hope to see the economy continue to improve throughout the year while at the same time seeing a slowdown in government spending.

We hope that everyone is continuing to stay safe, but also having the opportunity to get out from under the restrictions of COVID and once again enjoy their family and friends.