The third quarter of 2025 unfolded against a backdrop of transformative fiscal legislation, pivotal international trade agreements, and a key monetary policy adjustment. These developments highlighted ongoing tensions between slowing job growth and inflationary pressures, shaping investor sentiment across asset classes.

The One Big Beautiful Bill Act (OBBBA) was passed on July 4. It retained select provisions from prior tax laws, introduced new incentives, and eliminated outdated deductions at both the personal and business levels. Among the most impactful individual changes, the state and local tax (SALT) deduction cap increased to $40,000 from $10,000 starting with the 2025 tax year, subject to income phaseout limits, potentially easing burdens for residents in high-tax jurisdictions. In 2026, the lifetime estate and gift tax exemption will rise to $15 million for single filers and $30 million for joint filers, enhancing the opportunity for wealth transfer planning. At the macro level, the Congressional Budget Office projected the OBBBA would cost $3.4 trillion over the next 10 years and would exceed $4 trillion when including additional interest on the national debt.

Two major trade deals advanced U.S. economic ties abroad, alongside an extension of the existing China agreement. The U.S.-Japan deal, detailed in late July, secured $550 billion in Japanese investments into the U.S., alongside reductions in reciprocal tariffs to 15% from 25% and a reduction in automobile tariffs to 15% from 27.5%. The auto sector, representing roughly 21.5% of Japan’s total exports and employing over 8% of its workforce, stood to benefit significantly from these adjustments.

The U.S.-EU agreement, outlined in late August, established a baseline 15% U.S. tariff on EU goods—down from the 30% presented initially —while the EU committed $750 billion in U.S. energy purchases and $600 billion in U.S. investments above current levels. Certain elevated tariffs remained for specific goods, balancing market access with domestic protections. These pacts, combined with the China extension, fostered reciprocal investment flows and tariff moderation.

The Federal Reserve continued to weigh the merits of maintaining current interest rates versus implementing rate cuts, striving to curb inflation while safeguarding employment. The dual mandate diverged, with inflation ticking up slightly even as job creation weakened. In September, the Fed opted for a 25 basis point rate reduction, marking a calibrated response to these crosscurrents. This easing step addressed softening labor dynamics without alleviating price pressures, underscoring the Fed’s delicate balancing act.

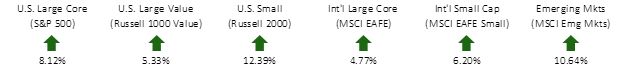

THIRD QUARTER EQUITY INDEX RETURNS

Global equity markets continued their strong charge forward in the third quarter. The S&P 500 notched a third quarter gain of a little over 8%, bringing its total year-to-date return to just shy of 15%. International developed and emerging markets have each returned over 25% year-to-date due to a combination of currency strengthening and positive local returns.

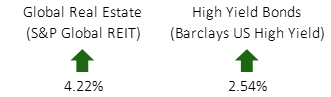

THIRD QUARTER ALTERNATIVE INDEX RETURNS

Global REITs and high yield bonds also saw gains in third quarter, adding to their already strong performance over the first and second quarters.

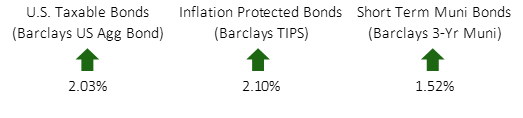

THIRD QUARTER FIXED INCOME INDEX RETURNS

Fixed income markets reacted favorably to falling interest rates, delivering positive returns across sub-asset classes for the quarter. The US Aggregate Bond Index is now up over 6% for the year.

Global financial markets performed well in Q3 2025, and year-to-date returns have served as a reminder of the importance of a globally diversified portfolio.

We hope you have a great fall and holiday season! If you have any market-related or planning questions, please reach out.