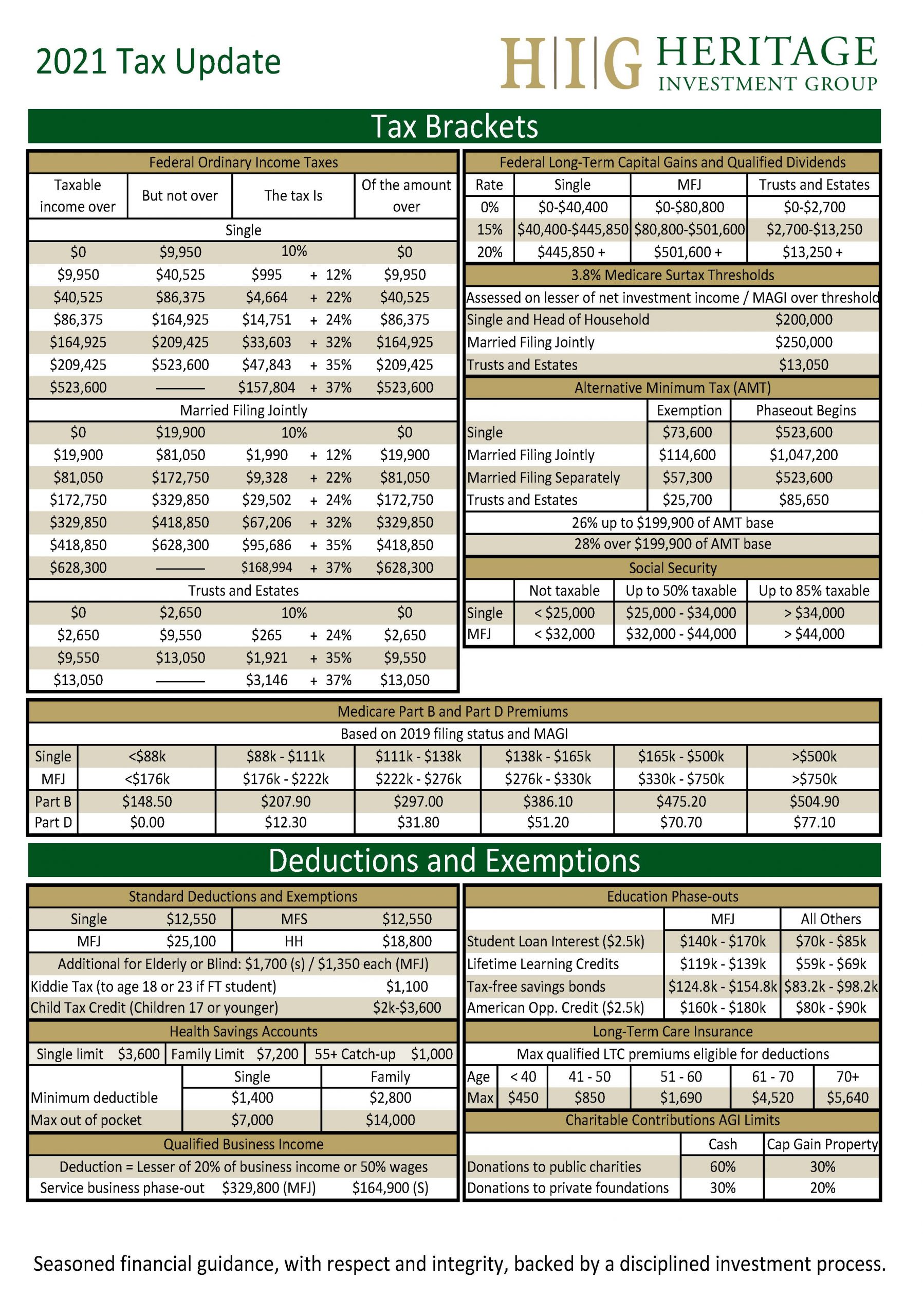

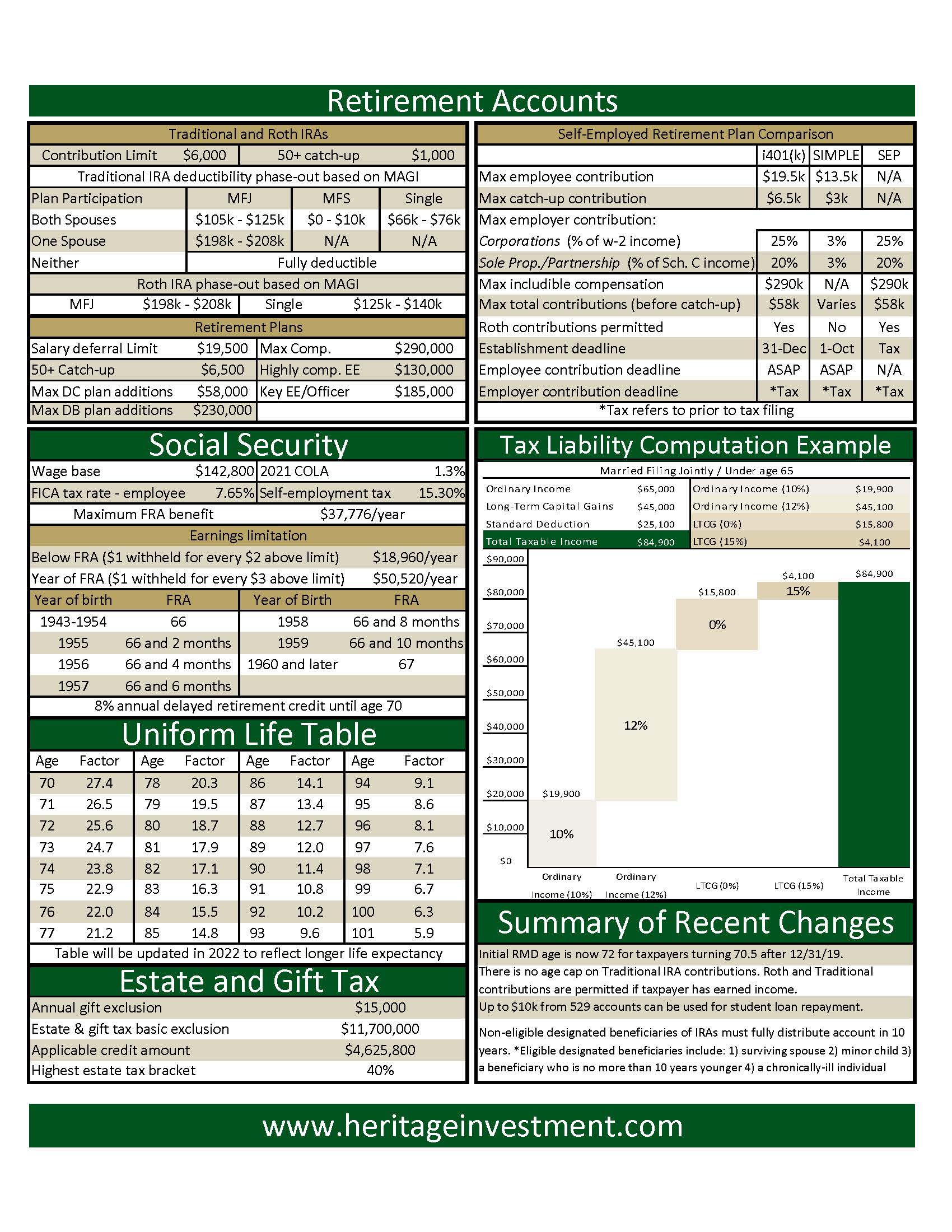

No matter how, when or why tax law changes and updates were made, they can hurt or help your bottom line. Proper tax planning begins with understanding what laws changed or were updated from the previous year. To help you out, we pulled together some of the most important changes and adjustments for 2021 and have provided them in the Heritage 2021 Tax Update below. Use this information now so you can hold on to more of your hard-earned cash next April when it’s time to file your 2021 tax return.

The information presented is obtained from sources deemed to be reliable but subject to change/correction and its accuracy is not guaranteed. Please consult your tax professional for additional guidance.

You can also find additional information about tax planning in the articles section of our website.